Sir Richard Branson is a pivot master.

The Virgin Group founder and billionaire has switched gears quite regularly in his ascent to entrepreneurial tsar. His first—and perhaps most important—occurred when he had barely left his teens, trading a publisher’s hat for that of music broker. Since then, Branson has dabbled in fashion, hospitality, space travel, soft drinks (Virgin Cola was a bust), and transportation, adjusting his focus on the latter from the way cars are sold to their power sources.

“…the idea that you can pivot and survive…is one of the things about pivot I think a lot of entrepreneurs like,” noted University of Pennsylvania Wharton School management professor Jacqueline “Jax” Kirtley, who has studied early-stage companies to better understand the way strategic changes impact startups. “If I know this isn’t working, I can pivot and I can still succeed. That’s something that is a good thing for entrepreneurs to know. Because most entrepreneurial firms fail. So knowing there’s an alternate—a way to survive, a way to change and move forward—that’s a good thing to know.”

It actually was critical knowledge for Sterile State LLC, a Farmington Hills, Mich., startup whose leaders are fighting to secure its future through a reincarnated business purpose. Founder/CTO Megan C. Frost, Ph.D., first developed the company’s core technology—nitric oxide (NO) inside a polymer—while heading a Michigan Technological University spinout established in 2016. That undertaking (FM Wound Care LLC) targeted the post-surgical wound care market, but SARS-CoV-2 disrupted its mission.

In step with Kurtley’s study findings, Frost pivoted as the pandemic receded and is now working to market Sterile State’s technology as a medical device sterilization solution. The timing couldn’t be better: The medtech industry is currently scrambling to find alternatives to ethylene oxide (EtO) disinfection in light of a U.S. Environmental Protection Agency (EPA) mandate to cut EtO emissions by 80% annually at all U.S. sterilization facilities. The new rules—to take effect in March—also would require sterilization plants to conduct real-time monitoring to ensure their pollution control efforts keep indoor EtO levels below 10 per billion in order to help reduce lifetime cancer risks amongst workers and host community residents.

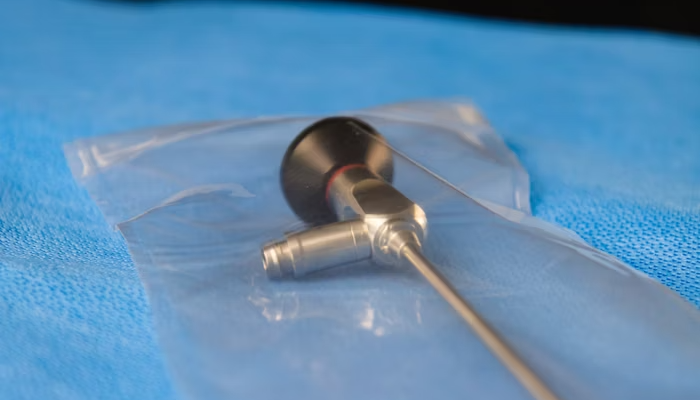

Sterile State’s NO sterilant technology reportedly would eliminate the need for EtO facilities as well as the fees, waiting times, and logistics associated with that cleaning method. The technology embeds NO in a polymeric system and releases the free-radical gas after an activation system. The polymer is added to the product’s packaging; once sealed, gas laws allow the nitric oxide to completely encapsulate the device, providing terminal sterilization until the package is opened.

The company has submitted its technology to the U.S. Food and Drug Administration (FDA) for approval.

“Nitric oxide is a free radical gas,” Frost said at a healthcare packaging event last spring. “It’s produced by virtually every cell in the human body, and what we’re doing is mimicking the way the human body eliminates microorganisms in living systems. So this is a natural system, it’s a natural sterilant, and it’s safe to tissues and organs in the human body…here’s the solution we’re proposing to answer the EtO challenge from the EPA and from the FDA…you create a package that contains a polymer, you simply put your device in that package, you seal the package, and that device is ready to be shipped to a customer who wants to have that available for use.”

Sterile State’s solution is just one possible replacement for EtO sterilization. Others include decontamination by carbon dioxide, nitrogen dioxide, vaporized hydrogen peroxide, and radiation. Such new approaches are bound to become more prevalent as the medtech industry struggles to comply with the EPA’s stringent new requirements.

The EPA’s EtO crackdown, however, is not the only issue facing medical device packaging and sterilization providers. To gain insight into other factors currently impacting the industry, Orthopedic Design & Technology spoke to nearly a half-dozen experts over the last few weeks. They included:

- Seán Egan, director of Global Marketing and VoC Development, Nelipak Healthcare Packaging, a Cranston, R.I.-based designer, developer, and manufacturer of custom designed packaging for the medical device and pharmaceutical industries.

- Don Kennedy, vice president, Sales and Marketing, at Guardian Medical USA, a Swanton, Ohio-headquartered designer/manufacturer of sterile barrier packaging solutions.

- John Nino, CEO of Brea, Calif., contract manufacturer Life Science Outsourcing.

- Don Tumminelli, senior technical manager, Client Services, at HIGHPOWER Validation Testing & Lab Services, a validation and testing laboratory in Rochester, N.Y.

- Tom Williams, general manager, Millstone Medical Outsourcing, a Fall River, Mass.-based customized outsourcing solutions provider.

Michael Barbella: Please discuss the market forces driving the latest trends in packaging/sterilization services.

Seán Egan: Europe’s Medical Device Regulation (MDR) has brought additional products into the fold that require a barrier-type package that must be protective of the device, reducing the risk of contamination. Where the device is to be sterilized, the package must ensure the device remains sterile under the storage and transport conditions specified by the manufacturer until the packaging is opened at the point of use. Packaging shall ensure the integrity of the packaging is clearly evident to the final user.

Additionally, the focus on sustainability continues to increase, with more customers looking into sustainable packaging options and more recyclable packaging components. When considering sustainable packaging options, it’s important to make sure you’re making a choice that’s compatible with the recommended sterilization process to prevent time-consuming delays that may create a backlog. Greater sustainability and waste reduction can be best achieved by optimizing packaging design—which can reduce material usage, as well as improve packaging functionality and allow for better product protection during sterilization, shipping, transport and storage.

Don Kennedy: Efficiency and economics; OUS [outside U.S.]: regulatory—MDR, Japan, U.K.; waste and recyclability; clinical workflows; single vs. dual barrier packaging and soon in the market competitive pressures; “Company A has sterile implants but not Company B, so who gets the sale? Contracts? Market entry?” Will some hospitals or buying groups mandate use of terminally sterile product in the U.S.? Look to Japan and the U.K. for that answer, it is yes.

John Nino: The medical device industry is experiencing significant changes in sterilization and packaging trends due to advancements in technology, regulations, and environmental sustainability. Low-temperature sterilization technologies, such as vaporized hydrogen peroxide, are becoming increasingly important to sterilize heat-sensitive medical devices. This trend aligns with new FDA standards like ISO 22441, which prioritize safety and efficacy.

In packaging, there is a noticeable shift towards the integration of technologies like QR codes and RFID. These technologies improve traceability and efficiency in device management, providing easy access to critical product information and streamlining inventory tracking in healthcare settings. Moreover, the industry is focusing on sustainable packaging solutions, moving towards the use of materials that are minimal, recyclable, or biodegradable. This shift is driven by both environmental concerns and regulatory and consumer demand for more eco-friendly packaging practices.

Antimicrobial additives are being incorporated into packaging materials to enhance infection control and patient safety. These market dynamics indicate an industry that is adapting to changing technological landscapes and regulatory requirements, with a heightened focus on environmental sustainability and patient safety considerations. CMOs like LSO need to stay aligned with these evolving industry standards and expectations.

Don Tumminelli: We have seen many manufacturers struggling with EtO residuals take a good look at their packaging to see how they can minimize the amount of packaging that contributes to EtO residuals.

Tom Williams: After a truly dire period, the outlook appears to be on a positive upward trend. In many cases, the industry has prioritized building supply chain resilience. This moves us beyond the worst of the widespread supply chain pressure that defined 2020 to early 2023. Other key forces include shifts in sterilization modalities, increased focus on sustainability in materials and packaging design, and continued risk management to ensure business continuity.

Barbella: How has material and/or component shortages impacted packaging? Has it caused providers to seek packaging alternatives?

Kennedy: Shortages and uncertainty illuminated what can happen with singular dependency on materials, methods, and suppliers.

Nino: Material and component shortages have significantly impacted the packaging sector of the medical device industry, causing a ripple effect on providers and their approaches to packaging. The increase in lead times for most packaging materials, often by as much as 2x, is a direct consequence of these shortages. This has pushed device manufacturers to seek alternative packaging materials that are more readily available. However, switching to different packaging materials isn’t a straightforward solution. Such changes can lead to even longer delays as they might necessitate re-validation of the packaging system, a process that is both time-consuming and resource-intensive.

As an effective solution to these challenges, pre-validated packaging for medical devices is becoming more popular. Pre-validated packaging offers a streamlined solution by providing packaging systems that have already undergone rigorous testing and validation processes. This approach can be particularly beneficial in the current environment of shortages and extended lead times. By choosing pre-validated packaging, OEMs can avoid the lengthy and costly process of packaging validation, reducing the time it takes to bring their products to market. This approach not only ensures compliance with regulatory standards but also provides a cost-effective and efficient solution to the challenges posed by material shortages.

Tumminelli: We have not experienced any significant loss regarding time or shortage of materials, mainly because of the heavy use of Tyvek grades used. With the backlog in actual contract EtO processing, customers have had plenty of time to source materials.

Williams: Shortages such as the Tyvek supply chain disruption have pushed the industry to be open to more readily available options. This has meant a shift away from a single, specific type of packaging. As a result, we are seeing more uptake on universal and pre-validated packaging options for new products and launches.

Barbella: What challenges, if any, do orthopedic devices introduce into the sterilization and packaging process (that are not present in other branches of healthcare such as cardiovascular)?

Egan: Packaging engineers are being challenged to cut costs by reducing the amount of packaging required to ship devices without compromising product integrity or the sterile barrier. With new product introductions, lead times for packaging development must be considered, as do new packaging formats or materials that require extensive validation testing, and if the trials are unsuccessful, costly delays are avoided. Consequentially, OEMs remain reluctant to embrace new packaging formats unless there is a strong business need to work outside of tried and tested solutions. Furthermore, instances of particulates inside of packages can cause a recall due to manufacturing issues. It’s important to work with a packaging CM that is ISO 13485-certified and can demonstrate strong Good Manufacturing Practice (GMP), producing products in ISO-classified cleanrooms.

Kennedy: Implant geometry, weight, sharp edges, coatings, surface protection.

Nino: Orthopedic devices are a challenge for sterilization and packaging due to their size, complexity, and material composition. Unlike other healthcare sectors such as cardiovascular, their large and intricate structures require specialized sterilization methods to ensure all surfaces are properly sterilized. The materials used, such as titanium and polymers, demand specific sterilization techniques to prevent damage.

Orthopedic surgeries involve a higher risk of bioburden, making rigorous sterilization necessary. Packaging must maintain sterility until use, which is challenging due to the diverse sizes and shapes of these devices. Moreover, the frequent reuse of orthopedic instruments means packaging and sterilization processes must withstand multiple cycles without degradation.

Regulatory compliance is also critical; OEMs are well-aware of the stringent standards for sterility and safety. Orthopedic devices require thorough validation of their sterilization and packaging processes. Environmental concerns also arise due to the need for larger amounts of packaging material.

To handle these complexities, OEMs should collaborate with experienced CMOs with extensive expertise in medical device sterilization and have knowledgeable microbiologists on staff. This partnership lets OEMs meet industry demands while maintaining speed to market.

Williams: Orthopedics introduces unique complexities of material and geometry, including heavy products, blind holes, an array of implant sizes and shapes, and more. These factors are considerations in cleaning and sterilization; these blind holes have to be cleaned and sterilized, for instance.

Barbella: How has the growing interest in sustainability impacted packaging design and/or material selection?

Egan: As customers look to reduce package size and material waste, they still need to ensure the package is compatible with the sterilization method (for example, with EtO sterilization). If the packaging isn’t designed to meet that process, it can result in damage to packaging, such as popped seals and damage to the package itself. For example, Tyvek is breathable and often used in EtO. But if you do the process too fast, the gas can’t get in or out fast enough, causing pressure to increase—the package can be physically damaged.

Kennedy: Hospitals are asking about sustainability and eco-friendly materials, and so are OEMs. Because packaging has a long-lasting effect (five to 10 years), choices and the resultant responsibility for the those choices (eco-friendly or not) are being taken into account by the OEM—and packaging producers!

Nino: The healthcare industry’s growing interest in sustainability is having a profound impact on medical device packaging, resulting in significant changes in both material selection and design. This shift is aligned with the industry’s efforts to promote sustainable practices and contribute to a circular economy.

One notable development in material selection is the increasing trend toward use of recyclable materials. High-density polyethylene (HDPE) is now commonly used in medical device packaging due to its recyclability. This material can be reprocessed into a variety of products for different industrial sectors, creating a more sustainable lifecycle for packaging materials and reducing the overall environmental impact.

In terms of packaging design, there’s a noticeable move toward bulk packaging to minimize material usage. This strategy allows manufacturers to accommodate more configurations and sizes in a single package, resulting in more efficient use of space on transport pallets. This reduces the materials used and lowers transportation and distribution costs. A notable example is the redesign of IV set packaging, which achieved a significant reduction in packaging area while maintaining performance, alongside an increase in production throughput due to more efficient packaging arrangements.

Tumminelli: Recycled content materials have been an interest with some customers and GPO contracts. So, as more and more contracts demand higher post-consumer content, it does create sourcing challenges. We see this more and more with European customers and notified bodies.

Williams: There is growing interest in sustainability in all industries, including medical device packaging—even as some aspects of the market have shifted toward more single-use items. Across the supply chain, stakeholders are looking at solutions, including reducing packaging footprint and considering recyclable or sustainable manufacturing materials.

Barbella: What kinds of alternative sterilization methods are companies embracing to reduce their dependency on EtO, now that the EPA is proposing to slash emissions by 80% annually? How will this impact the industry?

Kennedy: It looks like X-ray is going to be the go-to answer for the future. Great question for the sterilization companies!

Nino: The current lack of detailed guidance on alternative sterilization methods presents challenges for manufacturers who wish to transition away from EtO. Despite these challenges, several viable alternatives are being considered. One such alternative is chlorine dioxide gas, a gaseous method that is compatible with most materials. However, its use is currently limited mainly to industrial medical device sterilization. Another method gaining attention is nitrogen dioxide gas, which allows for room temperature sterilization and shares similar penetrative abilities as EtO. However, it has limitations, such as being unsuitable for sterilizing paper and potentially harsh on some materials.

Recently, the FDA recognized vaporized hydrogen peroxide (VHP) as an alternative to EtO. VHP is an environmentally-friendly option suitable for devices that can withstand its use. This recognition by the FDA is a step towards building a more resilient supply chain and preventing medical device shortages that might arise from reduced EtO use.

In addition to these alternatives, small batch EtO sterilization is an efficient and practical solution. This process involves sterilizing smaller quantities of devices, leading to reduced environmental impact, limited technician exposure, and less regulatory oversight. Small-batch EtO is considered safer and is ideal for mitigating health and environmental concerns associated with EtO. It also offers a solution to backlog issues, making it a strategic choice for manufacturers.

The transition to these alternative sterilization methods is crucial for the industry’s long-term sustainability and compliance with environmental regulations. While the path forward may be challenging, these alternatives represent a shift toward more environmentally conscious practices without compromising the effectiveness of sterilization processes.

Tumminelli: We have seen everything from chlorine dioxide, hydrogen peroxide, X-ray, and nitrogen oxide looked at as alternatives to EtO. How will this impact the industry? A device manufacturer looking to move away from EtO to an alternative process is looking at significant cost and time to revalidate a new process. This process could take anywhere from three to 10 years to validate the entire process.

Williams: For the last five years, medical device manufacturers have been grappling with ongoing sterilization disruption. With proposed regulatory changes on the horizon, OEMs must be proactive in seeking alternative sterilization methods. For continued EtO use, these include optimizing for lower concentrations, shorter dwell times, or both. OEMs are also embracing alternative methods, including gamma ray, X-ray, e-beam, chlorine dioxide, nitrous dioxide, and supercharged carbon dioxide. These shifts in capacity, regulation, and alternative methods will deliver us to a new normal—but it’s uncertain when.

Barbella: Where is the packaging/sterilization industry (for orthopedics) headed in the next five years?

Kennedy: I believe we’re going to see the largest-ever transition from reprocessed to terminally sterile packaging. The queue to support that shift must grow to accommodate it. Typically we see new projects (implants) starting with terminally sterile packaging; in the near future it will be reprocessed systems going to terminally sterile. This will cause a large drag on product development and logistics at OEMs and concurrently, an equal if not greater impact on packaging, testing companies, and sterilization companies. The transition is already in motion but no one sees it in the market yet. The classic innovators and early adopters are moving to terminally sterile with new flagship implant systems. Once those hit the market, the “followers” will be looking to jump in quickly. But that is going to meet with resource shortages.

Nino: Over the next five years, significant changes are expected in the orthopedic device packaging and sterilization industry. These will be influenced by a variety of emerging trends and evolving regulatory requirements.

Despite concerns over environmental and health issues, the industry is likely to continue relying on EtO for sterilization due to its effectiveness in sterilizing large volumes of devices. However, there will be efforts to make EtO processes more environmentally friendly and efficient, particularly in light of stricter regulations.

The industry will also explore and adopt alternative sterilization methods, such as vaporized hydrogen peroxide and nitrogen dioxide, which will need to be adapted to meet the specific sterilization requirements of orthopedic devices.

Personalization in packaging will gain traction, with a focus on accommodating patient-specific factors and the unique attributes of individual orthopedic devices. Alongside this, there will be an effort to simplify complex packaging systems to enhance operational efficiency and reduce costs.

The integration of technology in packaging will see an uptick, with QR codes and RFID technology becoming more prevalent. These technologies will improve supply chain tracking and traceability, ensuring better management and information dissemination from the point of sterilization to the end-user.

Small-batch EtO sterilization is set to become more common, which involves sterilizing smaller quantities of devices as a response to environmental concerns. This method aims to reduce usage of EtO gas, lessening its environmental impact and health risks.

Sustainability will remain a key driver in packaging design and material selection. The industry is expected to increasingly use recyclable materials and environmentally friendly designs, aligning with global sustainability goals.

Overall, the next five years for the industry will require balance between maintaining effective sterilization and packaging standards, adhering to environmental sustainability, and complying with evolving regulations. This will demand strong strategic partnerships between OEMs and CMOs with the expertise to adapt to the industry’s continuous innovation to ensure safe and efficient delivery of orthopedic devices to the market.

Tumminelli: There is a move for many device manufacturers to bring the sterilization process in house and in line with their manufacturing process. This gives them more control and allows for smaller batches to be processed. With this, they can sterilize product without the finale shipping cartons, lowering packing costs and residual limits.

Williams: The push toward sustainability will continue to gather momentum. This will include sustainability of packaging materials selection as well as around sterilization method. Building supply chain resiliency will also be at the forefront of the industry. Doing so will require OEMs and partners to ensure they’re working with the best supply chain partners on all materials up and down the supply chain.